The Catawba Digital Economic Zone: A Comprehensive Guide to Why It's the Perfect Place to Register Your DAO

Introduction:

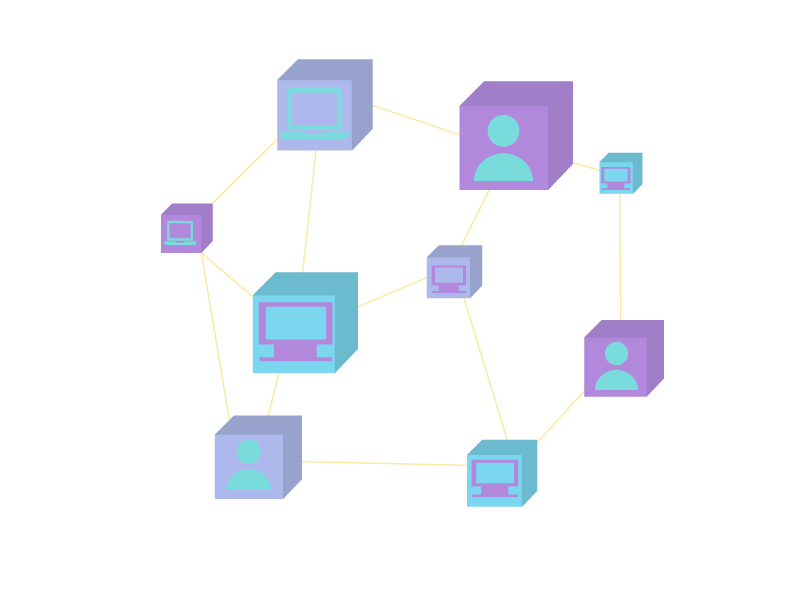

Decentralized Autonomous Organizations (DAOs) have emerged as a revolutionary way to conduct business in the digital era. As blockchain technology continues to evolve, it has become essential for jurisdictions to create regulatory frameworks that enable and support the growth of DAOs. The Catawba Digital Economic Zone (CDEZ) is a shining example of a jurisdiction that has not only embraced the concept of DAOs but has also implemented groundbreaking regulations to foster their development. In this comprehensive guide, we'll explore the many reasons why the CDEZ is the ultimate destination for registering your DAO.

Cutting-Edge DAO Regulation:

The CDEZ has recently introduced its DAO regulation, which allows users to incorporate DAO LLCs. This innovative regulatory framework effectively combines the benefits of traditional LLCs with the decentralized governance of DAOs. By creating a legally recognized DAO LLC, organizations can take advantage of a more transparent, efficient, and secure way of conducting business.

The CDEZ's DAO LLC structure provides a unique combination of traditional corporate benefits and decentralized governance. This hybrid approach enables DAOs to have the limited liability protection and tax advantages associated with an LLC while also benefiting from the autonomous decision-making and governance features that are inherent to DAOs.

In addition to the DAO LLC regulation, the CDEZ has also introduced a groundbreaking regulation for Unincorporated Non-profit Associations. This innovative framework enables non-profit organizations to enjoy a more flexible and efficient structure while still benefiting from the legal protections and advantages typically associated with more traditional non-profit entities. By providing a legal framework for these associations, the CDEZ encourages the formation of decentralized non-profit organizations that can operate effectively in the digital age.

Nimble Regulatory Body:

One of the standout features of the CDEZ is its nimble regulatory body. Unlike traditional jurisdictions, which often take years to adapt to technological advancements, the CDEZ has demonstrated its commitment to staying ahead of the curve. The Zone's regulatory body is quick to assess and adopt new and innovative regulations, which means that organizations operating within the CDEZ can be confident that they will always be at the forefront of the digital revolution.

The CDEZ has displayed its nimble regulatory approach by being the first jurisdiction to adopt the Uniform Law Commission's Amendments to the Uniform Commercial Code (UCC) to accommodate emerging technologies. The UCC is a body of uniform laws adopted by all US states to harmonize transactions across jurisdictions. These amendments, which were approved in July 2022, update the UCC to address emerging technologies, including digital assets, which the amendments classify as "Controllable Electronic Records."

The swift adoption of the UCC amendments by the CDEZ is a testament to its commitment to keeping pace with the rapidly evolving digital landscape. Unlike traditional jurisdictions, which typically take 12-24 months to adopt new UCC changes, the CDEZ reviewed and approved these complex changes within just 30 days.

Also, because these amendments are adopted, DAOs registered within the Zone have much stronger protections than competitor jurisdictions, like Wyoming.

Competitive Pricing Structure:

When it comes to the cost of registering a DAO, the CDEZ offers a highly competitive pricing structure. With an upfront fee of $250 (which includes the annual registered agent fee) and a $100 yearly renewal fee, the CDEZ is a more affordable option compared to jurisdictions like the Marshall Islands, which charges $5,000 per incorporated DAO.

The CDEZ's pricing structure allows businesses to save on registration and ongoing maintenance costs, enabling them to allocate more resources to innovation

Joseph McKinney, CEO, Catawba Digital Economic Zone.